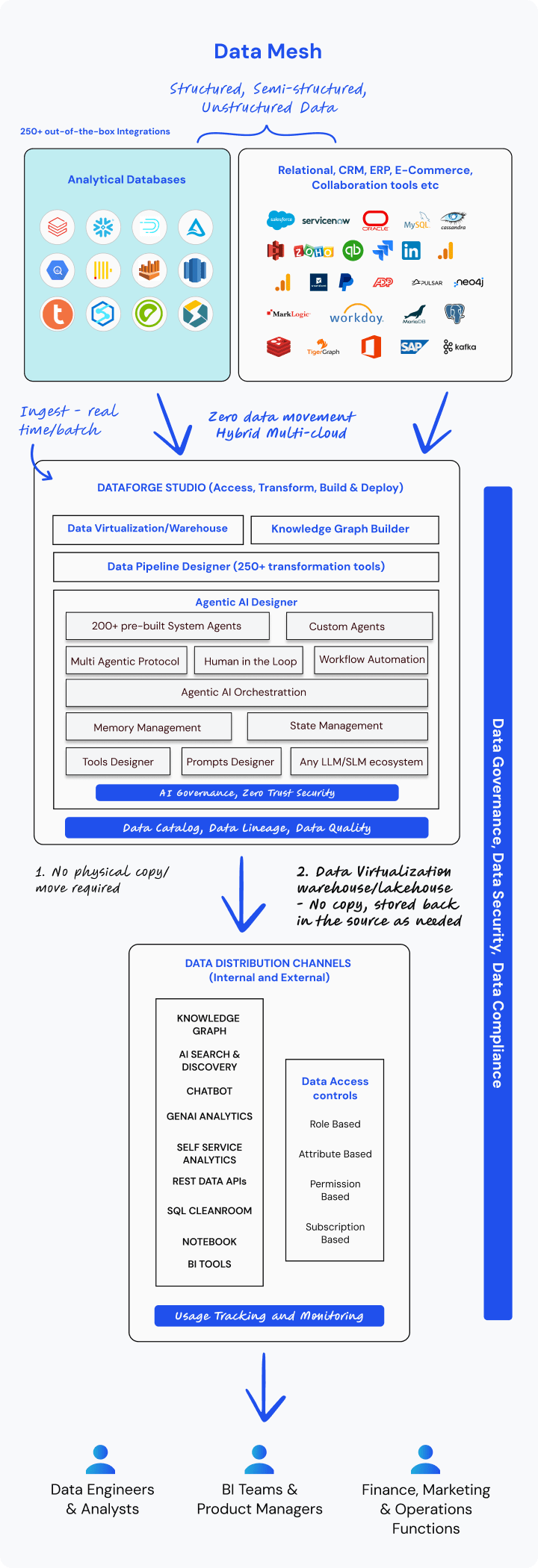

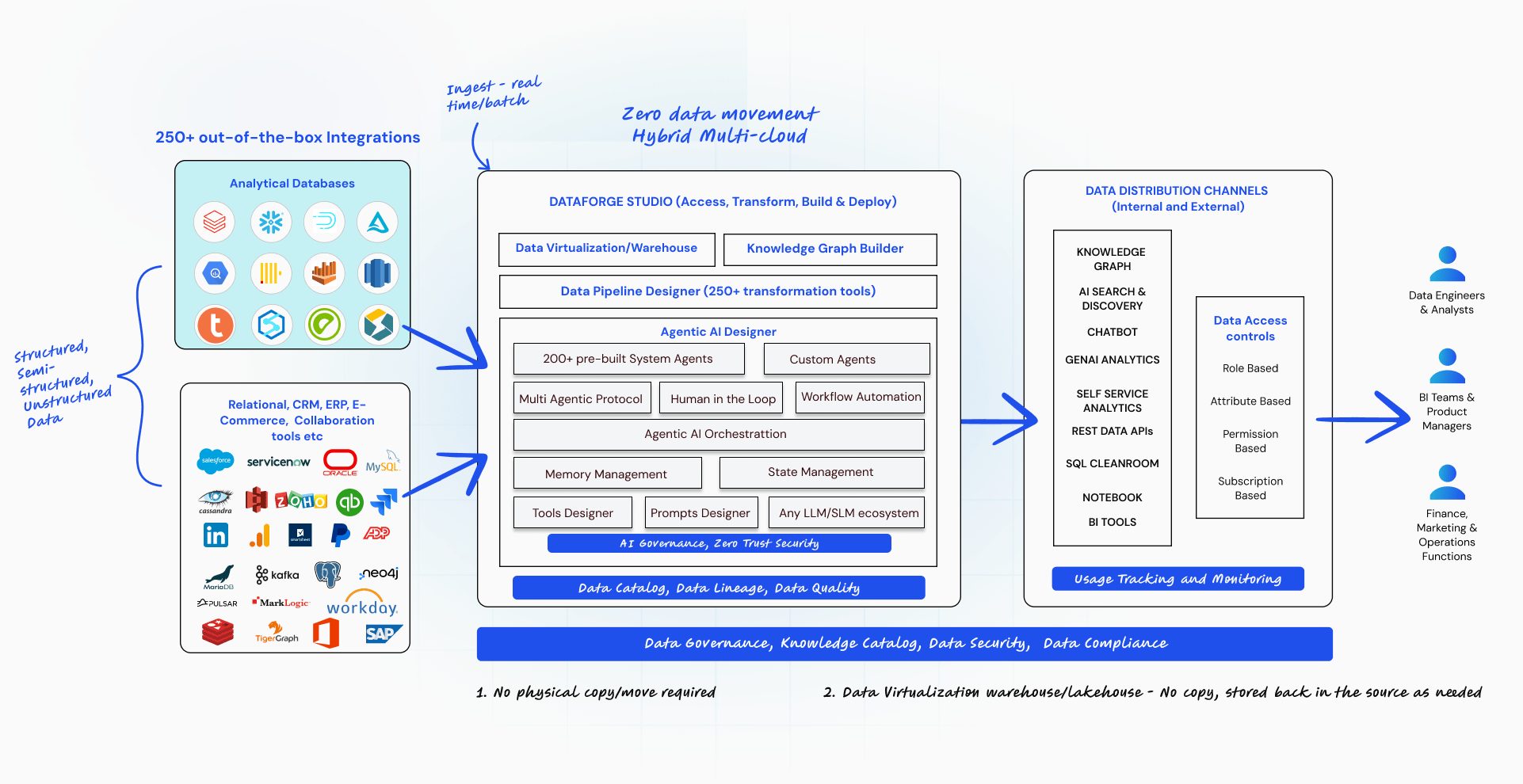

Agentic AI Platform for Real-Time Enterprise Data Management and Monetization

Unlock new revenue streams and build data products 10x faster with a no-code data fabric that’s 5x cheaper.

What We Offer

Make Every Decision Smarter with Arivonix AI

Agentic AI Intelligence

Governance & Compliance

Built-in guardrails, data lineage, CI/CD pipelines, and role-based entitlements.

Cloud-Agnostic Data Platform

Connects to 250+ sources across cloud and on-premises environments.

Data Virtualization

Access live data instantly without physical copies or movement.

Pipeline Designer Canvas

Drag-and-drop pipeline design with 200+ prebuilt components.

Data Catalog & Quality Management

Integrated data catalog, lineage tracking, and AI-driven quality checks.

Benefits

How Arivonix AI Is Different

How It Works

End-to-End Data Workflow Powering Insights

-

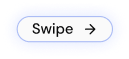

Ingestion from 250+ Data Sources

-

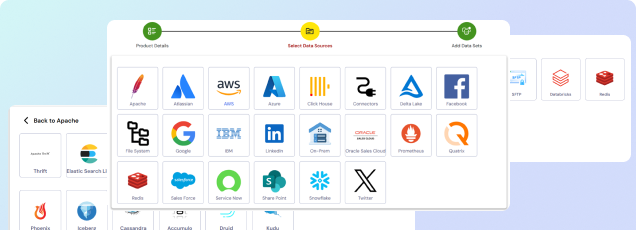

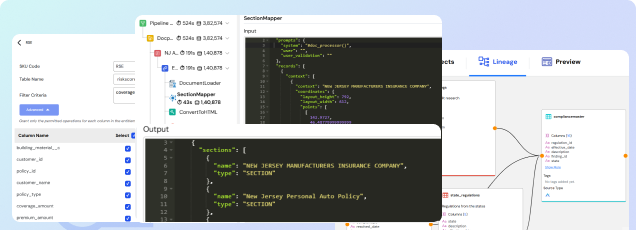

DataForge Studio

-

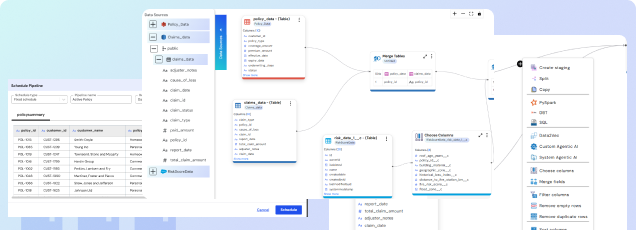

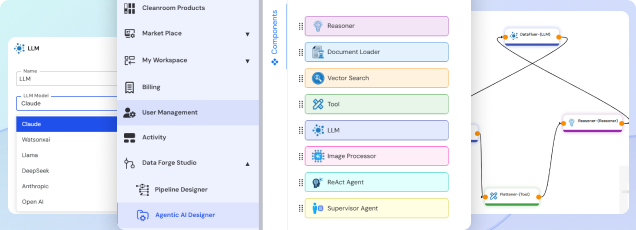

Agentic AI Designer

-

Data Products & AI Distribution

-

Data-Centric AI Assurance

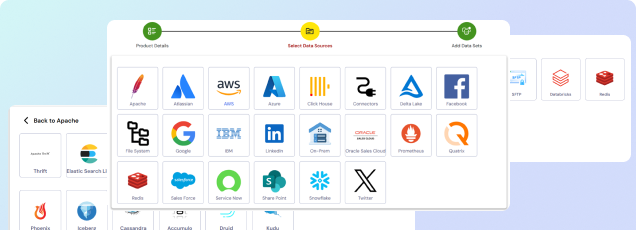

Ingestion from 250+ Data Sources

Connect to any cloud, data lake, on-prem systems, and live data streams in real time. Access structured, semi-structured, and unstructured data without duplication or complex integration. AI-driven virtualization delivers live data in seconds, not days.

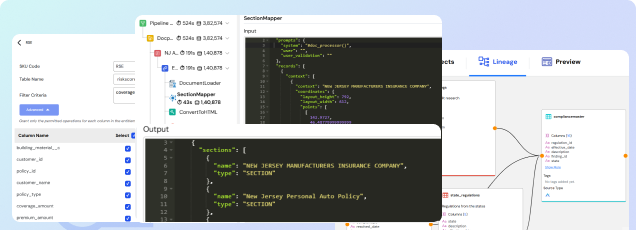

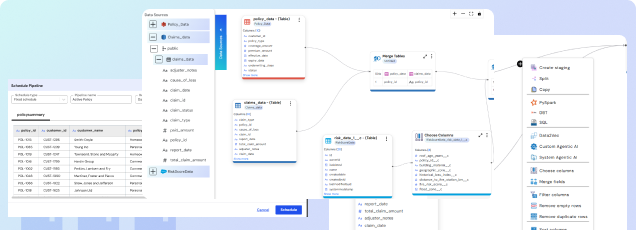

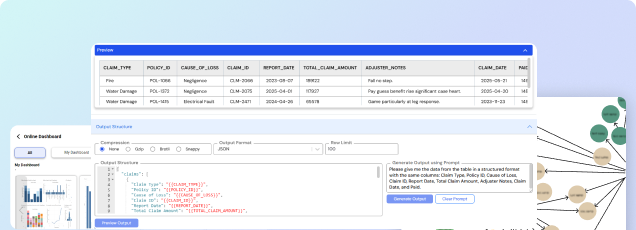

DataForge Studio

Once ingested, Design and automate pipelines with drag-and-drop simplicity. Apply instant no-code or advanced transformations, collaborate securely, and accelerate time-to-value without complexity.

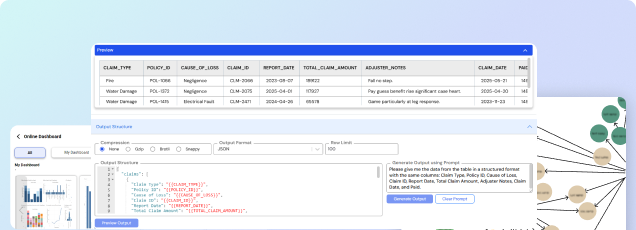

Agentic AI Designer

Turn pipelines into action with 200+ pre-built Agentic AI pipelines to build autonomous workflows. Combine agents, prompts, and LLMs into end-to-end, production-ready workflows all without writing code.

Data Products & AI Distribution

Convert curated workflows into governed, entitlement-driven data products. Enforce granular access controls, and distribute securely through APIs, dashboards, AI-powered search, notebooks, and SQL cleanrooms.

Data-Centric AI Assurance

Embed AI-powered governance and compliance from day one. Tri-secret encryption, SOC2 Type II, multi-layered controls, and automated lineage ensure data is always secure, private, and trusted.

How It Works

End-to-End Data Workflow Powering Insights

Agent Arivon - Your AI Data Engineer

Business Architecture

An End to End Agentic AI Platform