Agentic AI Platform for Insurance & InsurTech Industry

Transforming insurance operations with Agentic AI that learns, adapts, and optimizes every decision.

Major Challenges Impacting the Industry

Regulatory Pressure

Global insurers are grappling with overlapping mandates like DORA, IFRS 17, and new AI governance frameworks.

Only 25% of CEO-led transformation efforts are highly successful. (KPMG)

Legacy Technology

Outdated core systems continue to limit agility and speed across insurers and InsurTechs.

86% of carriers rate analytics as critical, but only 56% are satisfied with their systems. (BriteCore)

Customer Experience

Consumers expect seamless, personalized digital interactions across every insurance touchpoint.

61% of P&C carriers are exploring or piloting Generative AI for claims and service. (BriteCore)

Climate and Risk Modeling

Climate events are intensifying, straining traditional risk models and pricing accuracy.

Global insured cat losses were $60 billion in H1 2024, with 70% driven by thunderstorms. (Swiss Re Institute)

Arivonix AI SolutionsEnterprise AI You Can Trust and Deploy

Connect to the Insurance Data Ecosystem

Seamlessly link policy, claims, risk, and third-party data through 250+ virtualized data connectors, with zero data movement.

AI-driven ingestion automates mapping and validation for faster, cleaner, smarter decisions.

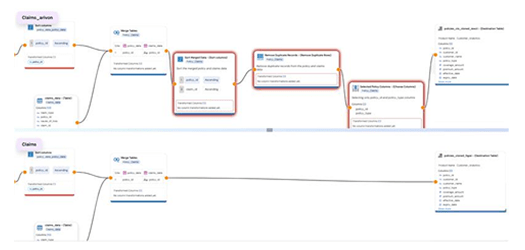

Accelerate Deployment & No-Code CI/CD

Enable Actuaries and Domain Experts to control data pipelines via the no-code Data Forge canvas reducing deployment from six months to one week.

Automate CI/CD workflows code-free for efficient iterations and reliable releases.

Agentic AI with 99% Accuracy & Trust Scores

Continuously learns from expert feedback to deliver precise, expert-validated outcomes in complex functions like claims adjudication.

Every inferred data point is paired with an auditable Trust Score, while the Human-in-the-Loop ensures granular validation & MRM compliance.

AI-Assured Enterprise Security

Operate within an enterprise-grade perimeter that’s HIPAA, SOC 1, SOC 2 Type II, and ISO 27001 compliant.

Arivonix’s tri-secret encryption, nano-segmentation, and policy-driven AI assurance ensure data lineage, model transparency, and auditability at every step.

Use Cases High-Impact Scenarios We Solve

Regulatory Compliance Automation

Transform High-volume and complex Regulatory Information into a Structured Data Model built to accelerate underwriting and claims processing. Empower Product Experts to manage changes in regulatory content, enabling 99% data integrity and adhere to regulatory compliance.

Financial Risk Management

Detect Claims Leakage Instantly Gain real-time insight into potential fraud by correlating claims data with evolving Policy Rules and external risk indicators across 250+ systems, significantly reducing loss costs and ensuring model auditability.

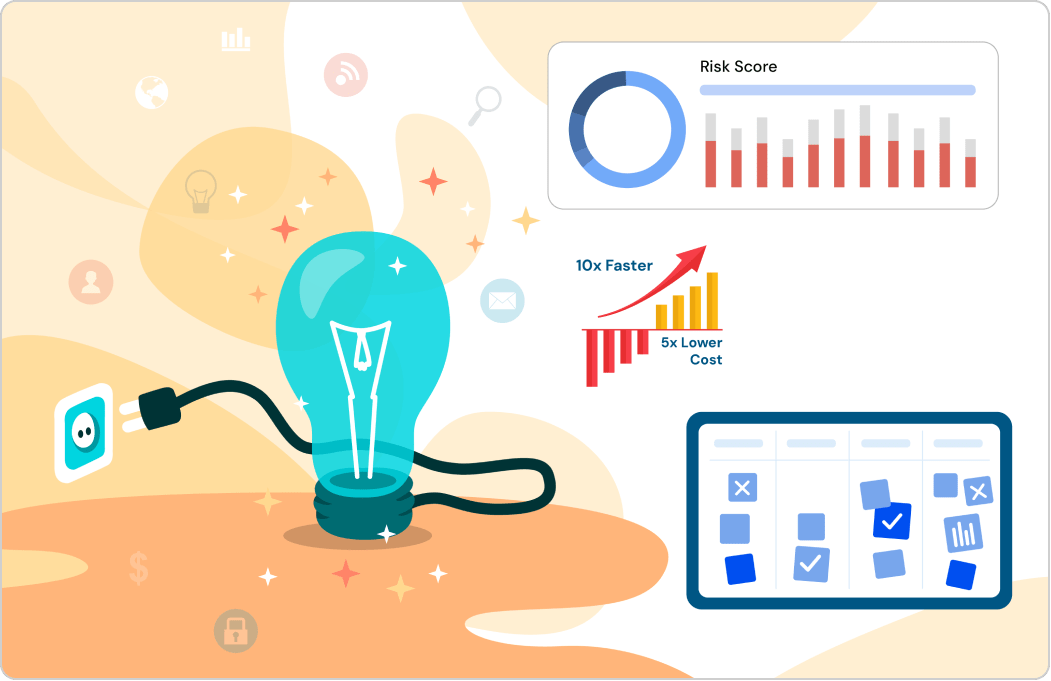

Product Innovation

Accelerate Data Product Launch Build and distribute new InsurTech data products (e.g., predictive risk scores, policy engines) via one-click APIs and dashboards, achieving 10x faster product delivery and 5x lower operational cost while enforcing strict data policies.

Expert Workflow Automation

Empower Actuarial Research Enable Actuaries and Underwriters to rapidly construct bespoke data agents for complex research using visual components, driving highly specific data retrieval and reducing dependency on centralized data teams.

Scenarios in Action

See how Arivonix AI streamlines insurance operations speeding modernization, supporting teams, and improving efficiency without legacy system changes.